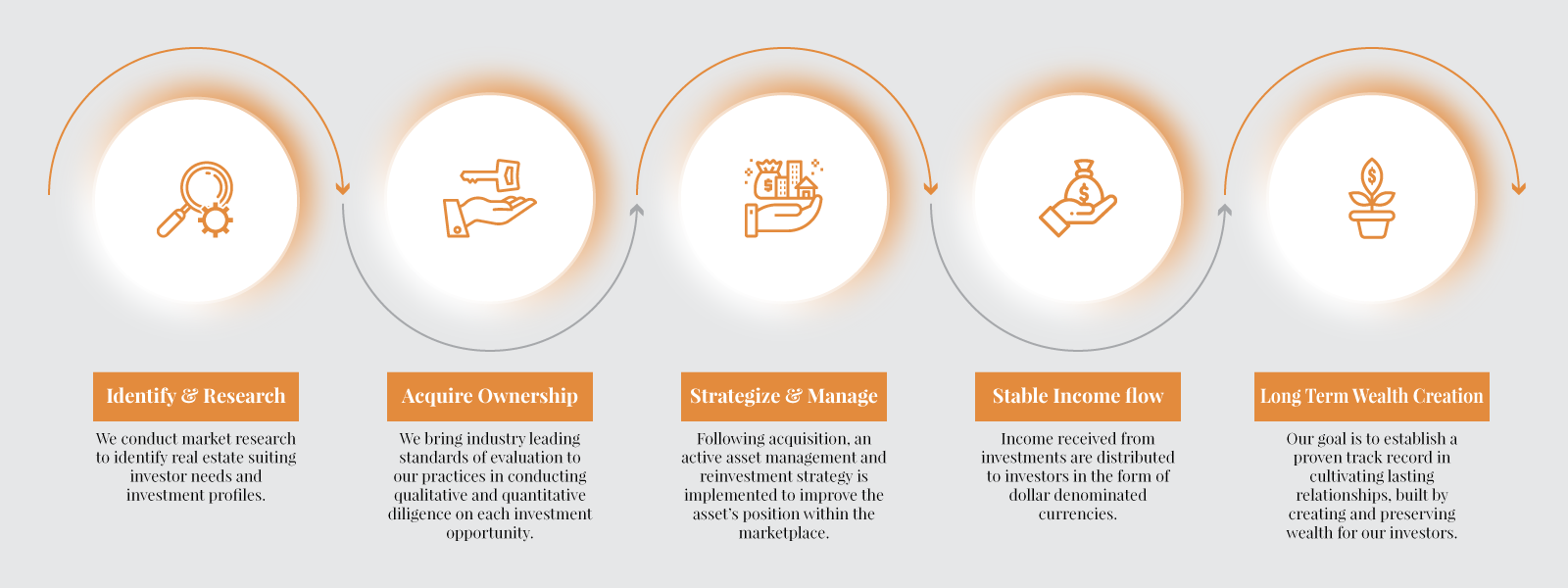

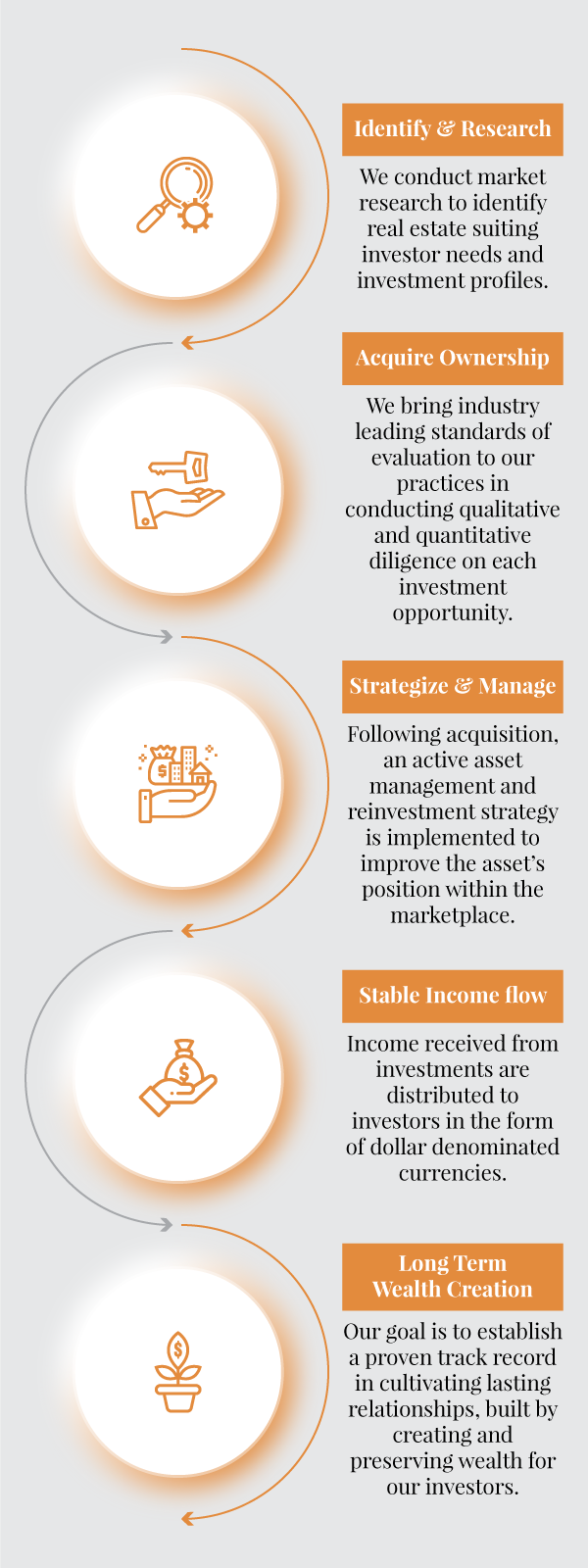

Our Business entails a “cradle to grave”, vertically integrated management encompassing acquisition, asset management and financial planning. This gives our investors the advantage of having all their real estate operating needs consolidated under the Veranda Holdings platform, enabling greater efficiency and functionality.

Each opportunity that we pursue is vetted with industry-leading standards of evaluation and diligence. Following acquisition, an active asset management and reinvestment strategy, tailored for the asset, is implemented by which Veranda Holdings seeks to improve the asset’s competitive position within its marketplace.

Our Strategies

- Core

- These opportunities have high barriers to entry and benefit from strong local urban economics. These types of assets are the most sought-after real estate by global investors looking to build a portfolio of secure assets.

- Core Plus

- Core Plus real estate investments are low to moderate in risk. Core Plus property owners often can increase cash flows through strategic capital improvements that upgrade the occupancy experience of its tenants.

- Value Add

- Often located in neglected urban submarkets with strong economic potential, these assets, by means of implementing concrete upgrade strategies, stand poised to deliver strong returns over a long-term horizon.